The Solution to Individual budget: Dominating Cash The board

Powerful administration of individual budgets is a fundamental ability that empowers people to achieve monetary security and satisfy their desires. The way to individual accounting is dominating cash the board, which includes planning, saving, effective money management, and settling on instructed monetary decisions. By executing vigorous cash the executives techniques, people can oversee their monetary fate and lay out major areas of strength for a for long haul achievement. This article dives into fundamental standards and systems for dominating cash the executives.

**Setting Monetary Goals**

*Characterizing Monetary Objectives:* Stress the meaning of articulating explicit monetary objectives, like putting something aside for retirement, buying a home, or sending off a business.

*Focusing on Goals:* Look at techniques for positioning monetary objectives and fostering an arrangement to accomplish them.

**Making a Budget**

*Surveying Pay and Expenses:* Urge people to screen and assess their pay and consumptions to acquire an inside and out comprehension of their monetary scene.

*Planning Techniques:* Present different planning strategies, including the 50/30/20 rule or zero-based planning, to productively apportion pay and guarantee monetary wellbeing.

**Saving and Crisis Funds**

*Significance of Saving:* Highlight the need of reliably saving a part of pay to address future monetary requirements and unforeseen occasions.

*Building a Crisis Fund:* Make sense of the benefit of laying out a secret stash to oversee unanticipated costs and give a monetary pad during difficult stretches.

**Overseeing Debt**

*Figuring out Various Kinds of Debt:* Explain the contrast between gainful obligation, (for example, understudy loans for training) and unfavorable obligation, (for example, exorbitant interest Visa obligation).

*Obligation Reimbursement Strategies:* Investigate techniques for overseeing and mitigating obligation, like the snowball procedure or obligation union.

**Effective money management and Abundance Building**

*Significance of Investing:* Examine how putting assumes a basic part in gathering long haul riches and achieving monetary objectives.

*Speculation Options:* Present different venture vehicles, including stocks, securities, common assets, and land, while stressing the meaning of expansion and hazard the executives.

**Savvy Spending and Monetary Choice Making**

*Careful Spending:* Rouse people to consider over their spending decisions, focus on fundamental necessities over wants, and look for an incentive for their cash.

*Assessing Monetary Decisions:* Explore methods for going with sound monetary decisions, like looking at costs, investigating choices, and looking for proficient direction when required.

**Ceaseless Learning and Monetary Literacy**

*Remaining Informed:* Feature the need of residual refreshed on individual accounting subjects, following dependable sources, and upgrading monetary comprehension.

*Looking for Proficient Advice:* Talk about the advantages of counseling monetary consultants or going to instructive studios to acquire experiences and settle on all around informed choices.

**Building a Strong Monetary Environment**

*Open Communication:* Advance straightforward conversations about monetary issues inside families or accomplices to guarantee adjusted objectives and responsibility.

*Peer Backing and Networks:* Represent the benefits of partaking in monetary networks or encouraging groups of people to share information, encounters, and guidance.

Dominating cash the board is indispensable for getting monetary soundness and accomplishing individual desires. By laying out monetary targets, creating a spending plan, saving steadily, overseeing obligation, contributing judiciously, settling on informed monetary choices, participating in nonstop learning, and developing a strong monetary climate, people can recover command over their funds and lay the foundation for a prosperous future. Allow us to embrace the standards of cash the board, foster sound monetary propensities, and endeavor to dominate individual accounting. With steadiness, information, and restrained cash the executives, we can explore the complexities of individual budget, beat monetary obstacles, and make ready for a more brilliant monetary future for us as well as our friends and family.

**Setting Monetary Goals**

*Characterizing Monetary Objectives:* Stress the meaning of articulating explicit monetary objectives, like putting something aside for retirement, buying a home, or sending off a business.

*Focusing on Goals:* Look at techniques for positioning monetary objectives and fostering an arrangement to accomplish them.

**Making a Budget**

*Surveying Pay and Expenses:* Urge people to screen and assess their pay and consumptions to acquire an inside and out comprehension of their monetary scene.

*Planning Techniques:* Present different planning strategies, including the 50/30/20 rule or zero-based planning, to productively apportion pay and guarantee monetary wellbeing.

**Saving and Crisis Funds**

*Significance of Saving:* Highlight the need of reliably saving a part of pay to address future monetary requirements and unforeseen occasions.

*Building a Crisis Fund:* Make sense of the benefit of laying out a secret stash to oversee unanticipated costs and give a monetary pad during difficult stretches.

**Overseeing Debt**

*Figuring out Various Kinds of Debt:* Explain the contrast between gainful obligation, (for example, understudy loans for training) and unfavorable obligation, (for example, exorbitant interest Visa obligation).

*Obligation Reimbursement Strategies:* Investigate techniques for overseeing and mitigating obligation, like the snowball procedure or obligation union.

**Effective money management and Abundance Building**

*Significance of Investing:* Examine how putting assumes a basic part in gathering long haul riches and achieving monetary objectives.

*Speculation Options:* Present different venture vehicles, including stocks, securities, common assets, and land, while stressing the meaning of expansion and hazard the executives.

**Savvy Spending and Monetary Choice Making**

*Careful Spending:* Rouse people to consider over their spending decisions, focus on fundamental necessities over wants, and look for an incentive for their cash.

*Assessing Monetary Decisions:* Explore methods for going with sound monetary decisions, like looking at costs, investigating choices, and looking for proficient direction when required.

**Ceaseless Learning and Monetary Literacy**

*Remaining Informed:* Feature the need of residual refreshed on individual accounting subjects, following dependable sources, and upgrading monetary comprehension.

*Looking for Proficient Advice:* Talk about the advantages of counseling monetary consultants or going to instructive studios to acquire experiences and settle on all around informed choices.

**Building a Strong Monetary Environment**

*Open Communication:* Advance straightforward conversations about monetary issues inside families or accomplices to guarantee adjusted objectives and responsibility.

*Peer Backing and Networks:* Represent the benefits of partaking in monetary networks or encouraging groups of people to share information, encounters, and guidance.

Dominating cash the board is indispensable for getting monetary soundness and accomplishing individual desires. By laying out monetary targets, creating a spending plan, saving steadily, overseeing obligation, contributing judiciously, settling on informed monetary choices, participating in nonstop learning, and developing a strong monetary climate, people can recover command over their funds and lay the foundation for a prosperous future. Allow us to embrace the standards of cash the board, foster sound monetary propensities, and endeavor to dominate individual accounting. With steadiness, information, and restrained cash the executives, we can explore the complexities of individual budget, beat monetary obstacles, and make ready for a more brilliant monetary future for us as well as our friends and family.

latest_posts

- 1

Top Pastry: What's Your Sweet Treat of Decision?

Top Pastry: What's Your Sweet Treat of Decision? - 2

How to watch 2026 Golden Globe winners like 'One Battle After Another,' 'Adolescence' and 'The Pitt'

How to watch 2026 Golden Globe winners like 'One Battle After Another,' 'Adolescence' and 'The Pitt' - 3

Woman gives birth on roadside after hospital allegedly sent her home: Family

Woman gives birth on roadside after hospital allegedly sent her home: Family - 4

Enormous Credit And All that You Really want To Be aware

Enormous Credit And All that You Really want To Be aware - 5

The Best Cell phone Brands for Tech Aficionados

The Best Cell phone Brands for Tech Aficionados

share_this_article

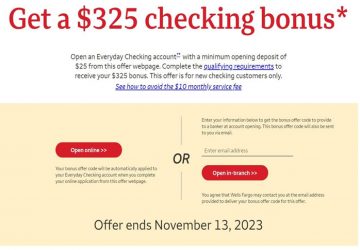

Figure out How to Score Huge with Open Record Rewards

Figure out How to Score Huge with Open Record Rewards Merz postpones Norway trip for Belgium talks on frozen Russian assets

Merz postpones Norway trip for Belgium talks on frozen Russian assets Idris Elba is the king of the stress-watch

Idris Elba is the king of the stress-watch Earth’s magnetic field protects life on Earth from radiation, but it can move, and the magnetic poles can even flip

Earth’s magnetic field protects life on Earth from radiation, but it can move, and the magnetic poles can even flip We tasted one of the 10,000 Hershey's Dubai chocolate bars being resold on eBay. Is it worth the hype?

We tasted one of the 10,000 Hershey's Dubai chocolate bars being resold on eBay. Is it worth the hype? Defeating An inability to embrace success in Scholarly world: Individual Victories

Defeating An inability to embrace success in Scholarly world: Individual Victories This Huge Ocean Beast Shifts Sharks’ Evolutionary Timeline

This Huge Ocean Beast Shifts Sharks’ Evolutionary Timeline Italy now recognizes the crime of femicide and punishes it with life in prison

Italy now recognizes the crime of femicide and punishes it with life in prison Health insurance premiums rose nearly 3x the rate of worker earnings over the past 25 years

Health insurance premiums rose nearly 3x the rate of worker earnings over the past 25 years